Aviation services concern Titan Aviation expanded into Indonesia in 2020 and added a Boeing Business Jet (BBJ), bringing fleet size today to 28 aircraft. It also added Guernsey approval to its existing four air operator certificates (AOCs), of which the San Marino’s is the most important.

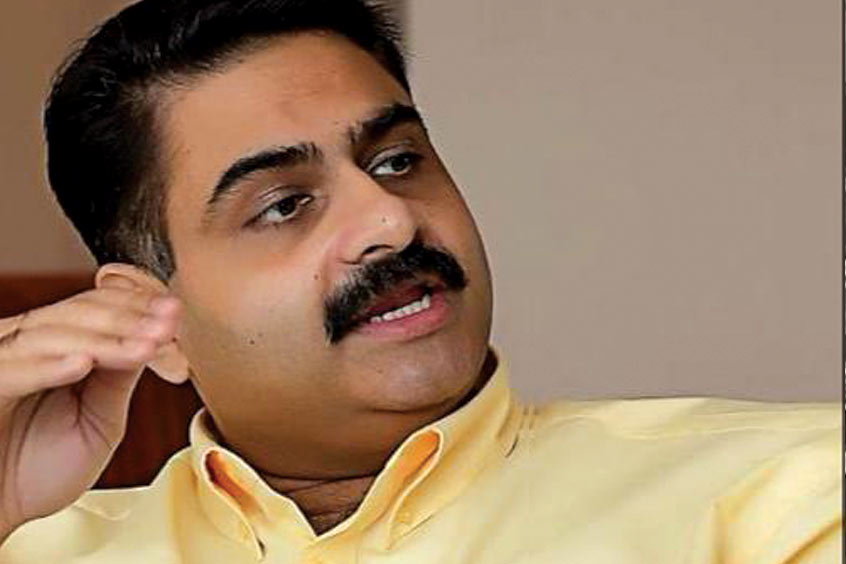

“For the first time, we added a BBJ under our San Marino operations,” managing director Sakeer Sheik told AIN. “That’s a 2016 aircraft based in the UAE, a big addition to the fleet. The private owner hopes to use it for charter in the future.” Sheik noted the organization has also added three other aircraft—two Hawkers and one Embraer 145—to its San Marino managed fleet. Further joining Titan’s San Marino AOC is a Falcon 50 based in the Democratic Republic of Congo.

Titan’s aircraft owners hail from the Middle East, India, Indonesia, and the U.S.; 70 percent are business leaders or corporations, but it also has single owners. “In 2022, we are probably looking at adding about 10 aircraft to the fleet,” he said. ”We expect to hit the 50-aircraft mark by end of 2023.”

In addition to the four approvals AIN detailed in 2018, Titan now has a Guernsey private operator certificate (POC) and has also secured IS-BAO Stage 2 approval.

“We actually expanded into new territory in 2020,” he said. “We moved into Indonesia with a fleet of three aircraft, locally based. You do have both island-hopping as well as international; the aircraft are busy. We also sold aircraft into Indonesia in the last few months, including a Praetor 600 for delivery in 2024.”

Sheik said India was booming. In the last two months, Titan signed up to 2,600 hours for one year on three aircraft: two light jets and one super-midsize. “That’s a one-year contract,” he said. “We have three years on all three aircraft together. That’s very good business for us. That’s how the charter business is performing in one of the most price-sensitive markets.”

During Covid, new people entering the market often became new owners, he said, after flying charter for a time. “It was not easy chartering these aircraft, so they started trying to buy them. If you look at how the market has behaved since the third and fourth quarters of 2020, it’s been a continuous upswing. Industry participants have all been signing up aircraft.

“There is always demand. Supply is short today, but there are always people who want to pay you money to buy an aircraft. For example, an aircraft valued at $10 million is listed in the market for $13 million. There are buyers at about $12 million or $12.5 million because they are desperate to buy. They will never see the delta between the actual value of 10 and buying price of 12.5, that it’s something that you write off for life. That’s where the market is these days.”

In terms of operating out of Dubai, Sheik said Al Maktoum International Airport (DWC) fit the bill well. “We are very comfortable with DWC,” he said. “It is a good airport; customers are happy with it these days. It has a good FBO setup. We have a tie-up with Falcon Aviation’s FBO. Falcon is functioning as an independent FBO at the DWC VIP Terminal today.”

Titan saw 5,500 revenue hours in 2021. “I don’t have the numbers off the top of my head, but in 2022 it’s going way above what we have predicted,” he said. “We will probably do over 7,000 hours.”

Sheik conceded that Titan had been a late starter in the U.S., despite having the Part 135 charter approval. “We’ve been waiting and watching the market; unlike, let’s say, the Middle East or Asia, the U.S. has a lot of players,” he said. “We wanted to go in with the right kind of strategy and business model, which creates value for the customers and is a win-win for everyone.

“Whenever I meet an aircraft owner there, I learn about new business models. We’ve been waiting and watching; we got hold of two or three good aircraft owners who are in sync with our thinking. All of us know that aircraft ownership is not an easy road to profitability. Our U.S. business is all light and midsize jets. We are now working on adding super midsizes to the fleet.”

From 2020, Titan’s Indonesia presence has helped it to branch out into Asia-Pacific, and the company is seeing strong activity in Singapore, Malaysia, Indonesia, Vietnam, and Thailand. “One of our core aims is to establish a much bigger base in that part of the world, to drive business coming from Singapore,” he said. “On Malaysia, we’ve been talking about at least five-to-seven aircraft in the next few months, to go into that part of the world, either for sale or under our management.”

Operating under the San Marino Aircraft Registry has been a boon, he said. “It’s the regulatory acceptance of the authority; it’s a neutral country. It’s very easy to get things done around the world. If you have a T7 aircraft, it’s the approachability of the authority. They give you solutions, and they get things done fast. Speed of delivery is very important, especially in the private jet business.”